I noticed that a lot of people on the right, hostile to the banking system, reacting badly towards the proposed idea of 50 year mortgages. They criticize it as being a boon to the banks and prolonging debt slavery.

IMO, as a bitcoiner, I am happy to take on a 50 year mortgage. Someone is essentially lending me worthless, depreciating assets (dollars) so I can use it to buy a valuable, appreciating asset (a home). Moreover, my repayment of the loan is denominated in terms of the worthless asset, so the real value of that loan is only going to go down over time.

If someone is willing to offer this to me, I don't consider myself enslaved. I consider myself lucky that someone would take the other side of that deal!!

In fact, a 50-year fixed rate mortgage (assuming it's fixed rate) probably wouldn't exist in the free-market without some sort of government backing. That should tell you that this is actually a good deal for the borrower, and not a good deal for the lender. The only reason lenders would do this is if they can offload the risk to someone else, i.e. the taxpayer.

So -- if you want to oppose 50 year mortgages, fine. But oppose it for the right reasons. Oppose it because it is a subsidy whose cost is borne by taxpayers; don't oppose it because you think it's debt slavery or a boon to banks. It's actually a boon to the borrower, and you can bet lots of savvy rich people will take advantage of it.

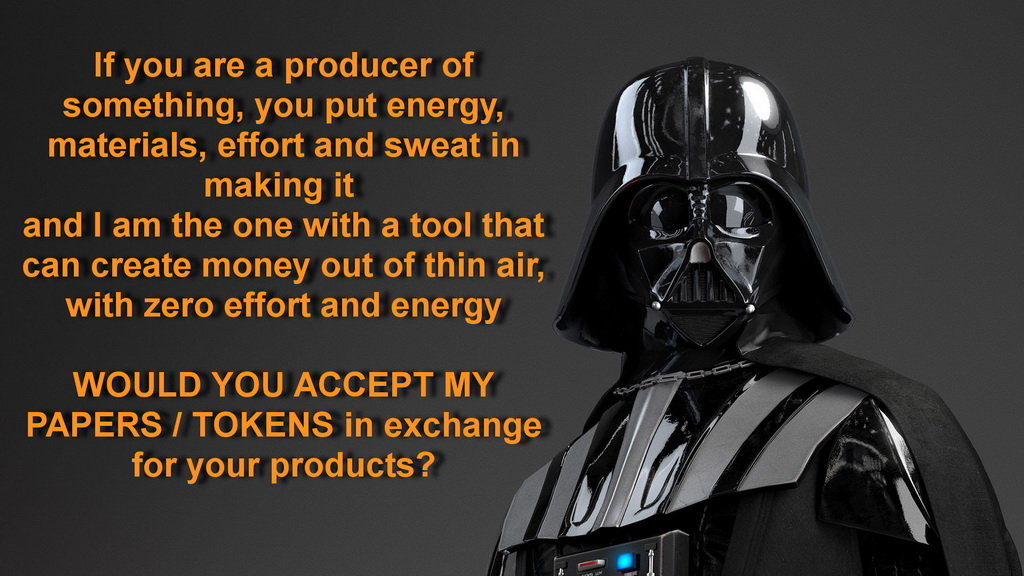

Why do I react so strongly about this? Because I see that this is how plebs keep themselves under the oppression of the fiat monetary system, because they don't understand finance. When I see people try to pay off their mortgages early, so they can own their home "free and clear", despite the mortgage being lower interest than what they could earn elsewhere, I shake my head. You've been given a great opportunity to denominate your debts in a rapidly devaluating asset, yet you decide to forgo the opportunity to acquire appreciating assets in order to pay down this nominal debt. It's the opposite of what rich people do, which is load up on debt to acquire assets. Stop falling for this! Realize that nominal debt denominated in dollars is debt that slowly disappears over time without you doing anything, and make smarter financial decisions.