Oh, beautiful.

Yes, yes, Strategy got a credit rating the other day... not, mind you, the one they wanted but whatever.

Last Monday, Michael Saylor, executive chairman of Strategy (formerly MicroStrategy), hailed what he described as a historic first for a bitcoin treasury company: Standard & Poor’s had assigned the firm a credit rating. Strategy’s online supporters immediately rejoiced.

Executive sum:

The restored junk rating is not a badge of honour. It just reaffirms what has been clear for some time: Strategy’s strategy of issuing lots of securities to accumulate bitcoin has failed to strengthen the company’s underlying financial position, leaving it dependent on capital markets access to service its existing obligations.

Oh, and this:

it’s difficult to understand why Strategy is trumpeting this development. For one thing, S&P bestowed a rating of B-, a whopping six notches into “junk” territory. The report didn’t exactly give a rousing endorsement:

OOPS!

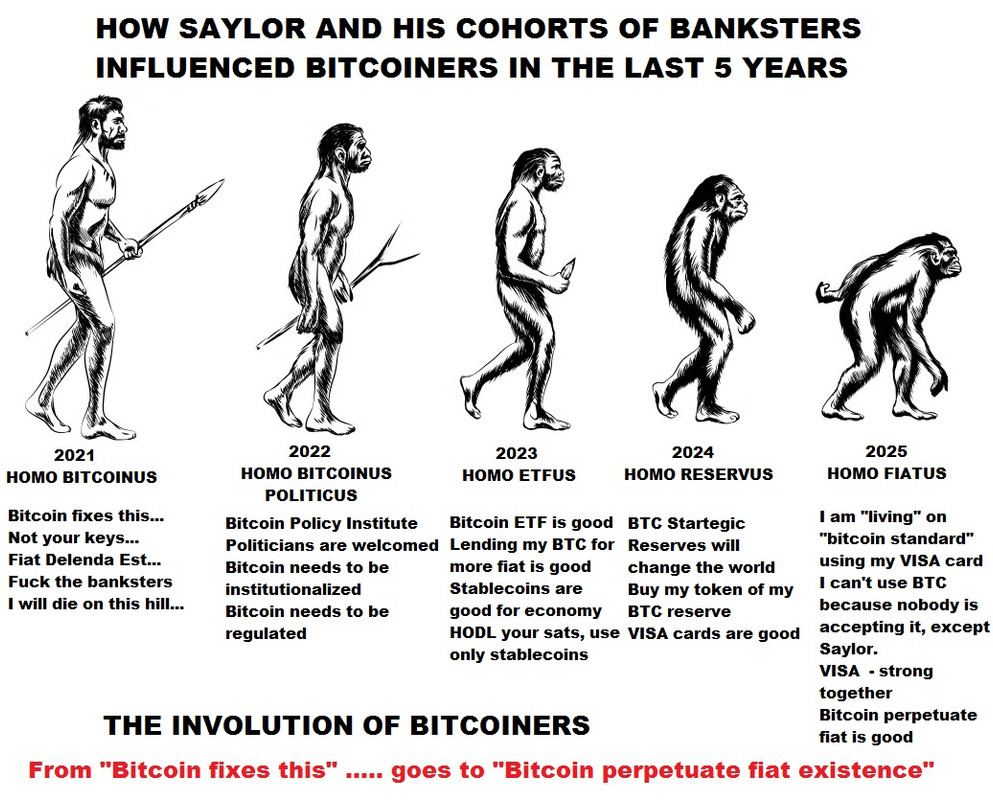

This was funny and ironic: trying to be edgy yet still embrace the same-old, same-old of the tradfi world:

Strategy presents itself as a bulwark against the debasement of fiat currency. Yet it seeks legitimacy from two of the oldest and arguably most discredited pillars of the ancien régime: sell-side equity research analysts (FTAV has already dissected Citigroup’s initiation report) and credit rating agencies

Nah, there's an anwer to this -- starts with the uncomfortable P-word (#1019584)

"The result is a financial loop in which one liability is funded either by creating another or by further diluting common stockholders."

Yet, this is the best:

SO LOOOONG, SUCKERS.

Junk?

Always has been.

ARchive:

https://archive.fo/IRpss